by Trefis Team https://www.trefis.com

Harley-Davidson (NYSE: HOG), whose stock currently trades at around $35, generates its revenue primarily from its Motorcycle segment, which is projected to account for 86% of total revenues in 2019, while the Financial Services are expected to contribute 14% to the top line. In this note we discuss the revenue segments of Harley-Davidson, their historical performance, and expected Total Revenue for 2019. You can look at our interactive dashboard analysis ~ Harley-Davidson’s Revenue: How does HOG make money? ~ for more details. In addition, here is more Consumer Discretionary data.

What Does HOG offer?

- Harley-Davidson Motor Company was founded in 1903. In 1986, Harley-Davidson, Inc. became publicly held and currently is the parent company for the groups of companies doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). The company specializes in heavyweight (601cc+) cruiser and touring motorcycles.

- The Company’s long-term strategy, announced in 2017, is to build the next generation of Harley-Davidson riders globally and includes the following 2027 objectives:

- Build two million new Harley-Davidson riders in the U.S.

- Grow the Harley-Davidson international business to 50 percent of its total annual volume.

- Launch 100 new, high-impact Harley-Davidson motorcycles.

- Deliver superior return on invested capital for HDMC that falls within the top quartile of the S&P 500.

- Grow the business without growing its environmental impact.

Operating Segments:

- Motorcycles and Related Products Segment: The Motorcycles segment consists of HDMC, which designs, manufactures, and sells at wholesale, on-road Harley-Davidson motorcycles as well as motorcycle parts, accessories, general merchandise, and related services. The Company conducts business on a global basis, with sales in the United States, Canada, Latin America, Europe/Middle East/Africa (EMEA), and Asia Pacific.

- Financial Services Segment: The Financial Services segment consists of HDFS which is engaged in the business of financing and servicing wholesale inventory receivables and retail consumer loans, primarily for the purchase of Harley-Davidson motorcycles. HDFS also works with certain unaffiliated insurance companies to provide motorcycle insurance and protection products to motorcycle owners. HDFS conducts business principally in the U.S. and Canada.

What Are The Alternatives?

- Major competitors are Triumph, Yamaha, Ducati, and Royal Enfield brands.

- Mediumweight and lightweight segment motorcycles are also an alternative, but Harley has started to add some of them in its offerings.

What Is The Basis of Competition?

- The principal factors that determine consumer vehicle preferences in the markets would include overall vehicle design, price, quality, available options, reliability, and functionality.

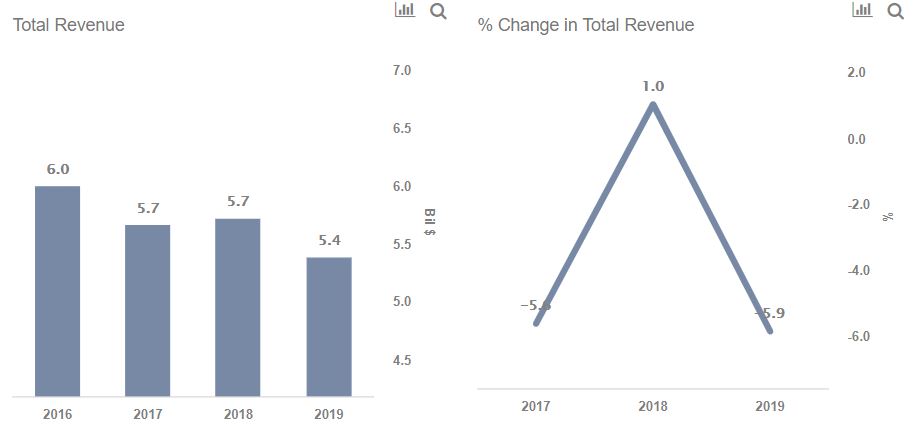

Harley-Davidson’s Total Revenue has fallen by 4.7% between 2016 and 2018, and is expected to fall further by 5.9% in 2019.

- HOG’s total revenues fell from $6 billion in 2016 to $5.7 billion in 2018. This represents a decrease of 4.7% primarily due to the Global Slowdown and Maturing US Market.

- We forecast the revenues to be around $5.4 billion in 2019, reflecting a further fall of 5.9% y-o-y.

Revenue expected to be around $5.4 billion, primarily from contribution of Automotive segment – For detailed bifurcation of Total Revenue please check our interactive dashboard – Harley-Davidson’s Revenue

- Revenue from Motorcycle and related products segment has fallen by 5.7% between 2016 and 2018, and is expected to fall further by 6.6% in 2019.

- Financial Services segment Revenue has grown by 3.2% between 2016 and 2018, but is expected to fall by 1.1% in 2019 amid the fall in sales.